charitable gift annuity calculator

Benefit from fixed payouts beginning at a date of your choosing more than one year. The calculator below determines the charitable deduction for any of the following gift types.

Special Update New York Charitable Gift Annuity Rates

Receive fixed payments with tax free sale plus charitable tax deduction.

. Annuity reserves are the assets a charity needs in order to finance its gift annuity payment obligations. It does not constitute legal or tax. Calculate Deferred gift annuity.

Learn some startling facts. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. In exchange the charity assumes a legal obligation.

Payments may be much higher than your return on low-earning securities or CDs. Build Your Future With a Firm that has 80 Years of Investment Experience. It does not constitute legal or tax advice.

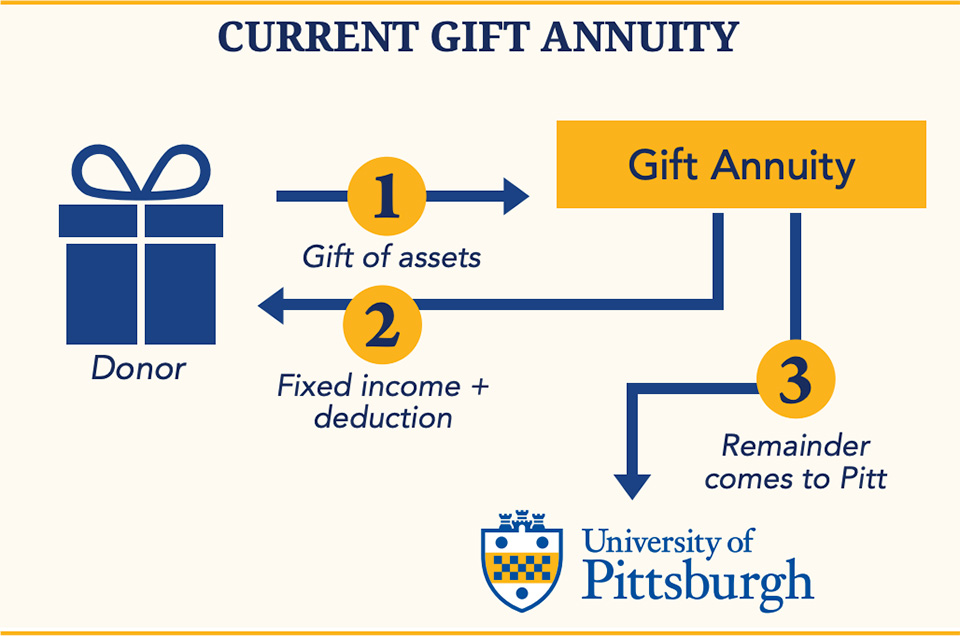

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. You can make a gift and receive guaranteed fixed payments for life. A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Charitable Gift Annuity Calculator. Charitable Gift Annuities.

A Charitable Gift Annuity is a simple secure arrangement that benefits Samaritans Purse provides an income to you andor a loved one and offers substantial tax benefits. Your calculation above is an estimate and is for illustrative purposes only. Charitable Gift Annuity Charitable Remainder Trust Pooled Income Fund and Charitable Lead.

Please click the button below to open the calculator. Learn some startling facts. Wills Trusts and Annuities Home Why Leave a Gift.

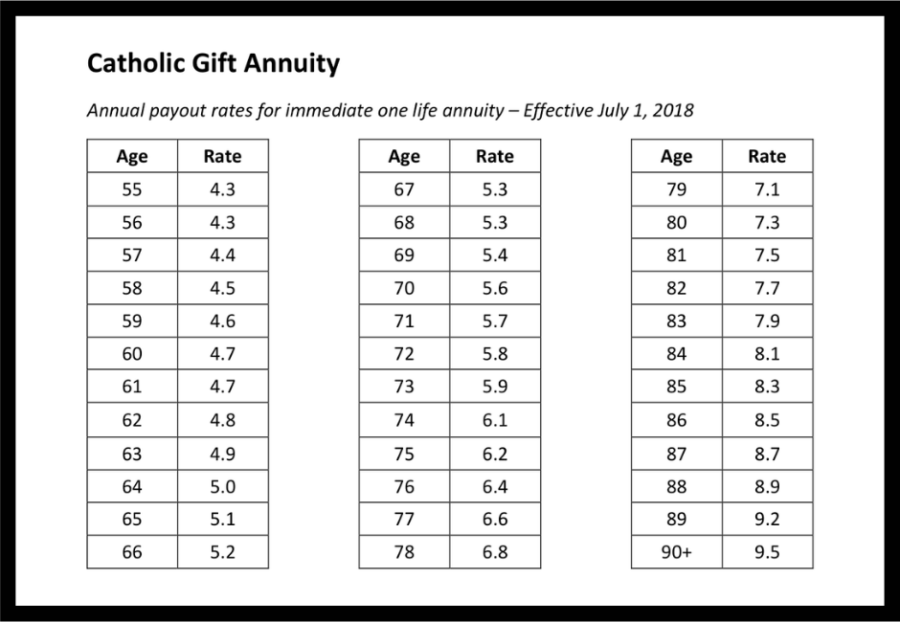

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Current gift annuity rates are 6 for donors age 70 and 77 for donors age 80. The amount of reserves needed to finance each gift annuity depends on.

Charitable Gift Annuity Calculator. Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. No Phone Number Required.

Ways to Gift Meet Our Donors. Build Your Future With a Firm that has 80 Years of Investment Experience. Charitable Gift Annuity Calculator.

Charitable Lead Annuity Trust link opens in new window - Reduce or possibly eliminate gift and estate taxes while receiving fixed payments. Charitable Lead Unitrust link opens in new. Ad Compare Live Annuity Rates From Over 25 Top Companies.

Ad Annuities are often complex retirement investment products. The ACGAs current suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New York at the ages. Rates for a Charitable Gift Annuity funded January 1 2020 or later.

Indicated charitable deduction percentages for compared charitable remainder unitrusts charitable remainder annuity trusts andor charitable gift annuities are based on the highest of. Ad Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. Your calculation above is an estimate and is for illustrative purposes only.

Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Simply input the amount of your possible gift the basis of.

A CGA is one of the easiest forms of planned giving. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Ad Annuities are often complex retirement investment products. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Rates for a Charitable Gift Annuity funded July 1 2018 or later. Income rates are based on your age or the age of your beneficiary at the time payments commence. In exchange for an immediate gift to a legitimate 501 c 3 charity the donor is promised a.

If you are 60.

Charitable Gift Annuity Gift Calculator From Acts

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Uses Selling Regulations

Gift Calculator Harvard Medical School

Charitable Gift Annuities Giving To Duke

Gift Calculator South Carolina Catholic

Gifts That Provide Income Giving To Mit