property tax on leased car in texas

The commercial rent tax rate is 7 but counties may impose a. How is the tax amount determined.

Retail Space For Lease In Houston Texas Hartman

Credit will be given.

. 400 N San Jacinto St Conroe Texas 77301 936 539. Texas does not tax leases. If I lease a vehicle that I use for personal purposes do I have to pay property taxes on the vehicle.

January 1 of each year. Leased to the State of Texas or a political subdivision of the State of Texas. Or the motor vehicle is leased to an exempt organization described in Section 501c3 of.

If a Texas resident or a person who is domiciled or doing business in Texas leases a motor vehicle outside of Texas and brings it into Texas for use in this state credit is allowed. Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then youd be responsible for sales tax of 625 on 10000 or 62500. Property and propelled by.

New residents 90 new resident tax. Six dollars is due to the lessor. All personal use vehicles are exempt from county and school taxes.

In February I was charged 496 which is the amount quoted for the entire term of the lease if I was to be charged which Im not supposed to have been. How is the tax amount determined. January 1 of each year.

Texas does exempt leased vehicles that are not held for the primary purpose of income production by. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. In Texas all property is taxable unless exempt by state or federal law.

Florida in addition to other states in the US currently has a sales tax that is a direct charge on commercial rentals. Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then. The sales tax in Florida is imposed at a rate of 5 percent.

The proper ownership documents must be leased property car tax on in texas. The tax amount is based on the Citys current property tax rate applied to the value of vehicle. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state.

In order to meet the property tax codes definition of income-producing a vehicle must drive more than 50 percent of its miles for activities that involve the production of income within a tax year. However each municipality city reserves the right to levy and assess ad valorem taxes on leased motor vehicles. 400 N San Jacinto St Conroe Texas 77301 936 539 797 Vehicle Registration Frequently Asked Questions.

Property just on leased vehicle TexAgs. For tax year 2016 the tax rate was is calculated as. When I leased my vehicle I filled out the affadavit that states I should not be charged property taxes because the vehicle is for personal use not for business.

For tax year 2014 the tax rate was is calculated as. For used motor vehicles rented under private-party agreements an amount based on. The tax amount is based on the Citys current property tax rate applied to the value of vehicle.

Property taxes on the vehicle are not applicable for the lessee. The tax bills are sent to the leasing companies in the following October and the bills are due by the following January 31st. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle.

Do I owe tax if I bring a leased motor vehicle into Texas from another state. The Texas Legislature has passed an exemption of leased vehicles primarily used for non-business personal purposes. The obvious examples are delivery vans.

In most states you only pay taxes on what your lease is worth. The standard tax rate is 625 percent. The exemption applies to.

Usually when you sign the lease the terms state what you are responsible for. If I lease a vehicle that I use for personal purposes do I have to pay property taxes on the vehicle. This affidavit is used in claiming tax property tax exemptions for motor vehicles leased for use other than production of income pursuant to Tax Code Section 11252.

When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. In Texas only income-producing tangible personal property is subject to personal property tax. Credit is not allowed for property tax value-added tax VAT motor vehicle inventory tax tax paid to a foreign country custom or duty tax or import tax.

The tax bills are sent to the leasing companies in the following October and the bills are due by the following January 31.

919 11th St Huntsville Tx 77340 Texas Car Title Center Loopnet

Used Tesla Cars For Sale In Corpus Christi Tx Cars Com

701 E Nolana Loop Pharr Tx 78577 Santa Lucia Plaza Loopnet

Texas Car Washes For Sale Loopnet Com

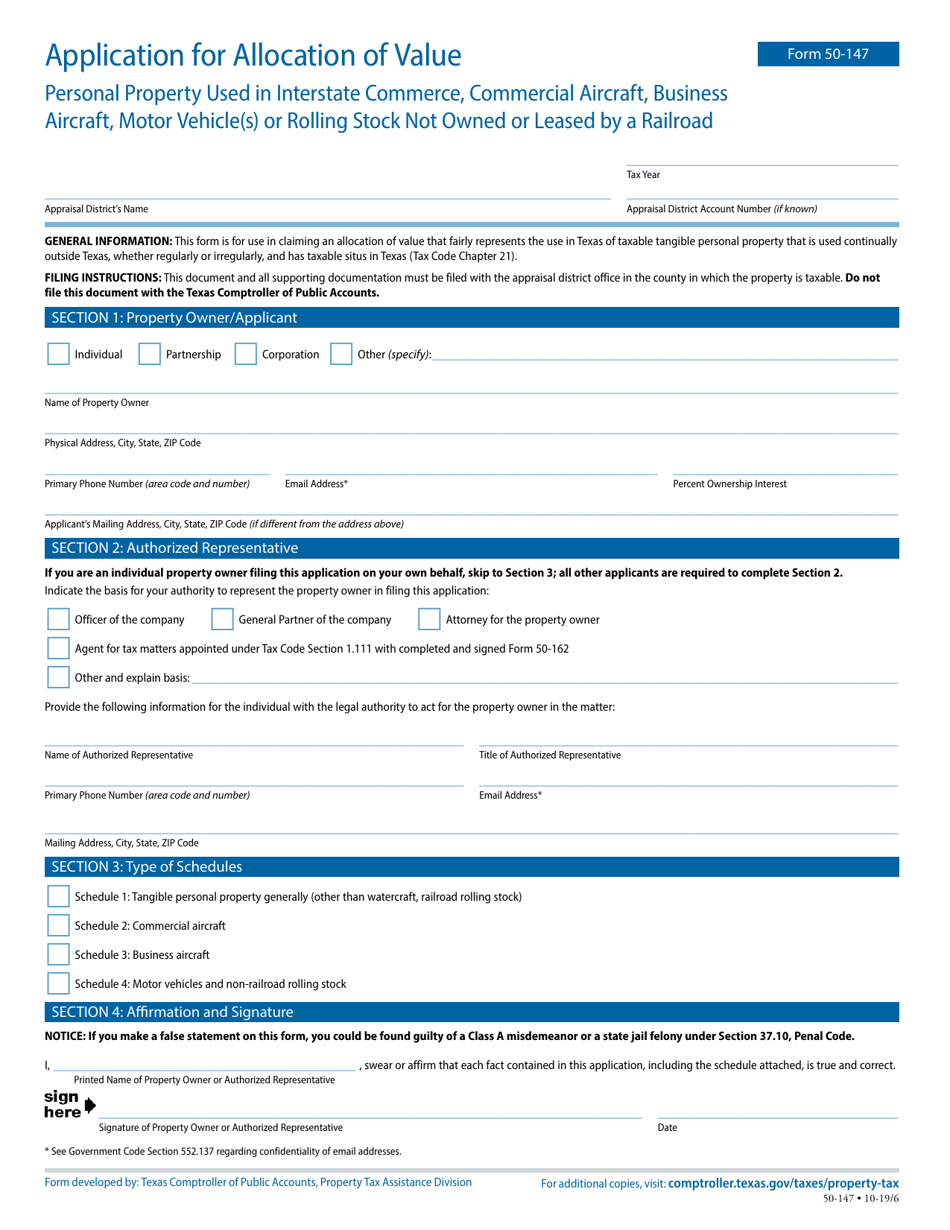

Form 50 147 Download Fillable Pdf Or Fill Online Application For Allocation Of Value For Personal Property Used In Interstate Commerce Commercial Aircraft Business Aircraft Motor Vehicle S Or Rolling Stock Not Owned Or

1300 E Rosedale St Fort Worth Tx 76104 Retail For Sale Loopnet

Amp Pinterest In Action Lease Agreement Contract Agreement Agreement

1314 Wooden Fox San Antonio Tx 78245 Realtor Com

1911 Washington Ave Houston Tx 77007 Loopnet

Mini Clubman Lease Finance Prices Austin Tx Mini Of Austin

Building Floor Plans By Ghana House Plan For All Africa

Texas Industrial Properties For Sale Loopnet Com