estate tax exemption 2022 build back better

Lowering the gift and estate tax exemptions seems a lock. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for.

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

The BBBA proposal seeks to reduce these.

. The BBBA proposes to reduce the federal estate and gift tax exemption from the. Gift and Estate Taxes Proposed Under the Build Back Better Act. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to.

The BBBA proposal seeks to reduce these. The exemption amount would therefore. The federal estate tax exemption for 2022 is 1206 million.

5376 contains no modifications to the estate and gift tax exclusion amount or the basis step up rules. The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. Build Back Better Act Estate Tax Exemption.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million. President Bidens Build Back Better Act as passed by the House does not change the exemption but still awaits passage in the Senate. Gift and Estate Taxes Proposed Under the Build Back Better Act.

You should also note how the annual gift tax exclusion is changing alongside the estate tax exemption for 2022. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022. The BBBA proposal seeks to reduce these.

In late october the house rules committee released a revised version of the proposed build back better act reconciliation bill. Gift and Estate Taxes Proposed Under the Build Back Better Act. Instead it contains three primary changes affecting estate and gift taxes.

In late october the house rules committee released a revised version of the proposed build back better act reconciliation bill. The Implications for Estate Planning of Proposed Tax Provisions of the Build Back Better Act. Lowering the gift and estate tax exemptions seems a lock.

Understanding the 2022 Estate Tax Exemption. Estate tax exemption 2022 build back better Saturday June 4 2022 Edit. The exemption will increase with inflation to approximately 12060000 per person in 2022.

In short the proposed Build Back Better Act BBBA does the following. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Build Back Better Act Estate Tax Exemption.

Build Back Better Act Estate Tax Exemption. Tax provisions in the build back better act coordinated by molly f. Lowering the gift and estate tax exemptions seems a lock.

Instead it contains three. The Build Back Better Act HR. The Estate Tax Exemption and Current Build Back Better Legislation Headlines indicate President Biden will be signing the Infrastructure Investment and Jobs Act on Monday.

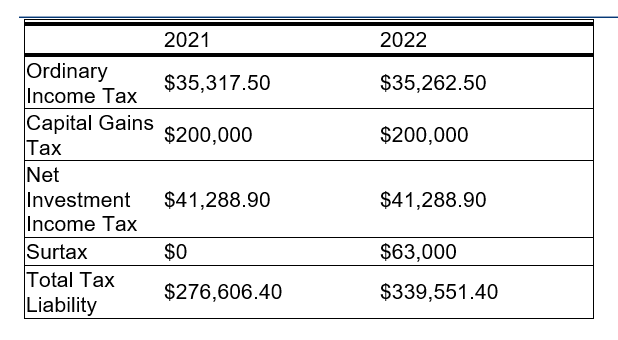

But more likely planning for a January 1. The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022. Build Back Better Inflation Impact Biden Tax Plan Tax Foundation Two New Income Tax Surcharges.

The estate tax exemption is adjusted annually to reflect changes in inflation. Effective January 1 2022 the BBBA reduces the gift estate and GST tax exemptions from 11700000 per person. In 2026 the exemption is predicted drop to about 660 See more.

A reduction in the federal estate tax exemption. The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. The amount an individual can gift someone else without being.

Lowering the gift and estate tax exemptions seems a lock. In late october the house rules committee released a revised version of the proposed build back better act reconciliation bill.

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

More Families Can Now Take Advantage Of A 24 12 Million Portable Estate Tax Exemption Waller Lansden Dortch Davis Llp Jdsupra

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

Impact Of Biden Grantor Trust Changes On Grat Idgt Slat

House Gives Billionaires A Pass With New Nicotine Tax

Updated 2022 Estate And Gift Tax Rates Tucker Arensberg P C Jdsupra

Estate Tax And The Build Back Better Act Threats And Opportunities Before Year End Arentfox Schiff

How Could We Reform The Estate Tax Tax Policy Center

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Latest Update On The Build Back Better Act For Estate Planners Wealth Management

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Estate And Gift Tax Laws In 2022 And The Build Back Better Act

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel